Off-Plan vs. Ready Properties in Dubai

Table of Contents

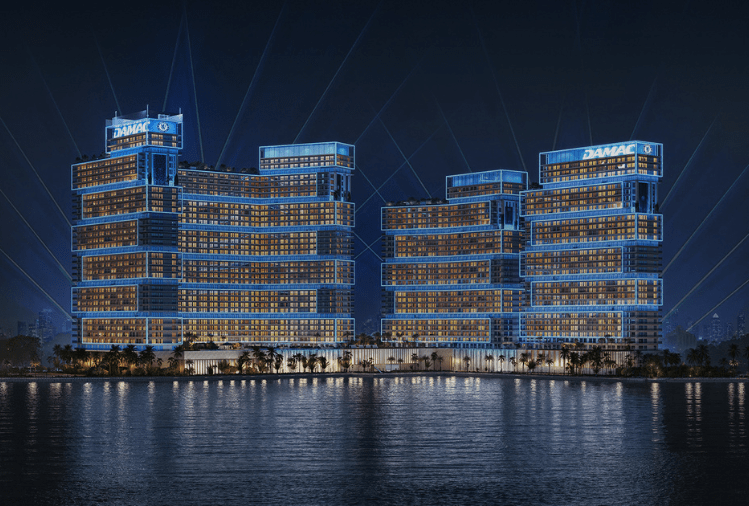

Dubai’s property market has become one of the most dynamic and attractive real estate environments in the world. From cutting-edge skyscrapers in Downtown to ambitious master-planned communities rising from the desert, opportunities for investors are vast. Yet when entering the market, many face the same question: should you buy a ready property or an off-plan property?

This decision is more than just a choice of timing. Each option comes with its own set of advantages, risks, and strategic uses. To bring clarity to the discussion, this guide draws on the experiences of Kevin McKenzie, co-founder of GenZone, who has personally invested in both ready and off-plan properties in Dubai.

Kevin explains:

“Over the years, I’ve bought both ready and off-plan units. Each has served a different purpose at different stages of my investment journey. But recently, I’ve found myself shifting toward one over the other — and there are clear reasons why.”

Let’s explore the pros and cons of both strategies, and what they mean for investors today.

The Case for Ready Properties

A ready property is straightforward: the unit is completed, registered, and available for immediate occupancy or rental. Investors can visit the property, walk through it, and see exactly what they are buying.

Pros of Ready Properties

Immediate Use and Cash Flow

Perhaps the most compelling advantage is immediacy. A ready property can be occupied or rented the day you acquire it. For investors focused on cash flow, Dubai’s rental market provides healthy yields.Kevin notes:

“Unlike in markets like Canada or the UK, where cash flow is often negative, Dubai’s rental returns are consistently positive. With a ready property, you can generate income from day one.”

Access to Mortgages

Financing options are more accessible for ready units. Banks and lenders can accurately assess the property’s value, making it easier to secure a mortgage.Certainty of Product

You can physically inspect the unit before buying. This removes uncertainty about build quality or delivery timelines that off-plan projects sometimes face.Golden Visa Eligibility

Ready properties that meet the investment threshold qualify buyers for Dubai’s Golden Visa — granting long-term residency and making the UAE a secure base for global investors.

Cons of Ready Properties

While the benefits are clear, ready units also come with challenges.

Maintenance Costs

Older properties may require frequent repairs. Even with a property management company, investors are responsible for upkeep.Kevin shares an experience:

“I had a water leak in one of my units that damaged the flooring underneath. These issues add stress, especially if you’re a high-income earner who values peace of mind.”

Difficulty in Finding Deals

Dubai’s market is competitive. Sellers are rarely in distress and often unwilling to negotiate.“We’ve had sellers refuse to reduce their price by even 5,000 dirhams. They’d rather wait it out,” Kevin explains.

Large Upfront Capital

While mortgages are available, many investors, particularly international entrepreneurs, end up paying 50–100% upfront due to lending restrictions.Rental Management Burden

Even with management companies, there is always a mental load associated with rentals: tenant turnover, rental yields, and property condition.“You never stop thinking about it — who’s in the unit, is it rented, what’s the ROI? For some people, that mental energy just isn’t worth it.”

The Case for Off-Plan Properties

Off-plan properties are purchased before they are built, usually directly from developers, with staged payment plans. These projects often attract investors seeking capital appreciation rather than immediate rental returns.

Pros of Off-Plan Properties

Lower Entry Point

Investors typically secure properties at prices below current market value, though some premium projects may price higher due to demand.Kevin recalls:

“I spoke to an investor who told me he was willing to accept lower returns just to get into the market. He couldn’t qualify for a mortgage, so an off-plan payment plan was his only way in.”

Strong Capital Appreciation

Well-selected off-plan projects often appreciate significantly by handover.“One client bought a villa on Dubai Islands at 8.5 million AED. Comparable properties in the area are selling for 13 to 15 million. That’s the type of opportunity that makes off-plan so powerful.”

Flexible Payment Plans

Payment schedules spread across construction phases act as a built-in form of financing, without bank approval.Golden Visa Access

Recent rule changes allow investors to qualify for a Golden Visa even before construction begins.Lower Immediate Costs

With payments tied to construction milestones, investors commit far less upfront capital compared to buying ready.

Cons of Off-Plan Properties

As with any investment, risks exist.

Delayed Projects

Construction delays are not uncommon. Developers may struggle to sell out projects, which slows progress.Kevin points out:

“The safest strategy is to buy into projects that sell out quickly. If demand is there from day one, construction tends to stay on track.”

Quality Uncertainty

Unlike ready units, investors cannot verify quality until handover. Choosing a developer with a proven track record is essential.No Immediate Cash Flow

Until handover, the property cannot generate rental income. For investors seeking passive income, this may not align with their goals.Financing Limitations

Mortgages are unavailable until handover. Payment plans substitute for financing, but they require discipline and liquidity.

Comparing Returns: Ready vs. Off-Plan

The choice often comes down to investor priorities.

Ready properties are better suited for those seeking stable rental income and long-term end-use security.

Off-plan properties are typically favored by those chasing capital appreciation and higher returns on equity.

Kevin summarizes it this way:

“If you buy the right off-plan project, your appreciation can outperform the rental income of a ready property. The key is selecting the right project, in the right location, from the right developer.”

Kevin’s Perspective: Where the Market Is Heading

Over the past year, Kevin himself has shifted his strategy.

“When I started, I leaned toward ready properties. I liked the cash flow and the certainty. But as Dubai’s market has evolved, I’ve increasingly favored off-plan projects. The returns have been stronger, the payment structures are more flexible, and with the Golden Visa now available even before construction, it makes a lot of sense.”

He adds:

“That said, it depends on the investor. Someone looking for stable rental income might prefer ready. But if you’re aiming for higher growth and can handle waiting for handover, off-plan often wins.”

Practical Advice for Investors

For those considering entry into Dubai’s market, here are Kevin’s top recommendations:

Work with Reputable Developers

Only consider developers with a consistent track record of delivering quality projects on time.Analyze the Area

Look for master-planned communities with strong infrastructure, schools, and retail — factors that drive end-user demand.Understand Your Investment Goals

Decide whether your priority is rental income (ready) or capital appreciation (off-plan).Plan for Liquidity

Ensure you can comfortably meet off-plan payment schedules or ready property mortgage requirements.Seek Expert Guidance

Partnering with a local consultancy can make a significant difference in finding and securing the right deal.

Final Thoughts

Dubai remains one of the world’s most exciting real estate markets, offering both ready and off-plan opportunities that suit different investor goals. Ready properties provide immediate use and rental income, while off-plan investments promise higher potential returns and lower upfront capital.

The decision is ultimately personal, but as Kevin emphasizes:

“There’s no one-size-fits-all. The best choice depends on your goals, your financial situation, and your risk tolerance. What matters is making an informed decision with the right guidance.”

GenZone: Helping Investors Make the Right Move

At GenZone, Kevin and his team have guided hundreds of clients through Dubai’s real estate landscape. From securing properties to obtaining Golden Visas, GenZone helps investors make decisions that align with both financial goals and lifestyle aspirations.

For investors ready to explore Dubai’s property market with expert support, GenZone offers consultations, property tours, and personalized strategies.

Book a call today or visit the GenZone office in Dubai to take the next step in your investment journey.