How To Open Wio Bank Account For Business (FULL GUIDE) + TIPS

Table of Contents

Introduction

So, you’re planning to set up a bank account in Dubai, either because you’ve already set up a company or you’re thinking of doing that first. The notion of opening a bank account in Dubai can seem a bit intimidating to many, but with the right guidance, it’s quite manageable.

In this article, we’ll walk you through the entire process of setting up a company and a bank account in Dubai, sharing tips and tricks to make the journey as smooth as possible.

The article discusses the key requirements for opening a bank account in Dubai and how to set it up with one of the UAE’s famous digital banks, Wio Bank.

Step 1: Setting Up Your Company

Before you can open a bank account in Dubai, you must first establish a company. This is a necessary step because banks require a business license and a valid UAE company to process your account application. You have two primary options for registering your company in Dubai:

Free Zone Company

This is a popular choice for many international entrepreneurs. Free Zones in Dubai offer benefits like 100% foreign ownership, tax exemptions, and a range of other advantages. Each Free Zone has its own specific regulations and industry focus, so it’s wise to choose one that aligns with your business needs.

Mainland Company

Setting up a Mainland company allows you to operate throughout Dubai and the UAE. However, you need a local Emirati sponsor or partner who holds at least 51% of the company shares. This option can offer more flexibility in terms of business operations and market access.

Step 2: Obtaining a Residency Visa

Once your company is set up, the next essential step is obtaining a residency visa. This visa is necessary to open a bank account, and you will need to be physically present in Dubai to complete this process. Here’s how it works:

Entry Permit

First, you’ll need an entry permit to enter Dubai. This is usually handled by your business setup service provider. After you arrive in Dubai, you’ll proceed with the residency visa application.

Medical Check-Up

You’ll need to undergo a medical examination at an authorized clinic in Dubai. This is a routine procedure to ensure you meet health requirements.

Emirates ID

After passing the medical check-up, you will receive your Emirates ID, which serves as your official identification card in the UAE.

Step 3: Opening Your Bank Account

With your residency visa and Emirates ID in hand, you’re ready to open your bank account. While there are numerous banks in Dubai, the process can vary slightly from one bank to another. Here’s a general overview of what you need to do:

Choose a Bank

Dubai hosts a variety of banks including Emirates NBD, RAK Bank, and others. One standout option is Wio Bank, which has gained popularity due to its user-friendly approach and robust digital banking features.

Prepare Your Documents

Typically, you’ll need to provide the following documents to open a bank account:

Company Documents

Business license, company registration documents, and a company profile.

Personal Documents

Passport copy, residency visa, Emirates ID, and sometimes proof of address.

Bank Application Form

Complete this form with accurate details about your business and your role in it.

Submit Your Application

Depending on the bank, you may be able to start your application process online, but you’ll usually need to visit the bank in person to finalize the setup.

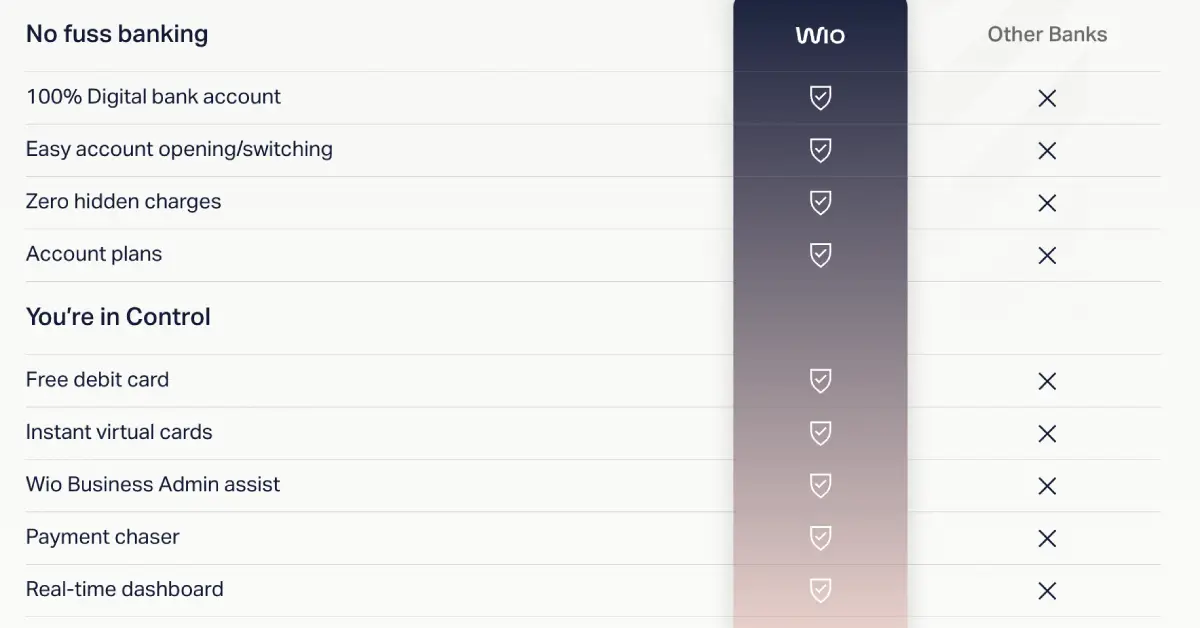

The Wio Bank Advantage

Wio Bank is an excellent option for many due to its ease of use and modern digital platform. Here’s why Wio Bank might be the right choice for you:

Digital Convenience

Wio Bank offers a seamless digital application process. You can start your application from anywhere, but remember, the final steps must be completed in Dubai to ensure your account is fully active.

Quick Processing

Once your company and residency are set up, Wio Bank can often process your application within a few days. You’ll need to stay in Dubai until you receive your physical bank cards, as the bank does not ship them internationally.

Banking Features

Wio Bank supports multiple currencies, including AED, USD, EUR, and GBP. Their digital platform also integrates well with Apple Pay, which can be very convenient.

Key Points to Remember

Stay in Dubai

To ensure that your Wio Bank account is fully activated, you need to remain in Dubai until you receive your physical bank cards. Without these cards, your account will only have partial functionality, meaning you can receive money but not send it.

Account Activation

The process from getting your residency visa to fully activating your bank account typically takes about 1 to 2 weeks. During this time, you can expect your account to be partially active until you receive your cards.

Cash and Crypto

Banks, including Wio Bank, generally do not favor large cash transactions or crypto activities. It’s important to plan your transactions accordingly and avoid raising any red flags.

FAQs

-

What if My Application is Rejected?

If Wio Bank rejects your application, unfortunately, you cannot reapply with the same attempt. Ensure your application is completed accurately and your company is properly set up to avoid rejection.

-

Can I Withdraw Cash Without a Physical Card?

Yes, Wio Bank offers the option to withdraw cash using a code generated through their app, which can be used at ATMs.

-

Do I Need a Company Website?

While Wio Bank may ask for a company website, it’s not mandatory. You can skip this part if you don’t have one.

-

Do I Need to Pay for Assistance?

If you use our referral code (C94), there’s no additional charge for our assistance. It’s a free service to help you with the application process.

Final Thoughts

Setting up a company and bank account in Dubai might seem complex, but it’s manageable with the right information and support.

The key is to follow the steps diligently, prepare your documents thoroughly, and be aware of the specific requirements for each bank. If you choose Wio Bank, their digital-first approach can offer added convenience, but remember to stay in Dubai until your account is fully active.

If you have any more questions or need personalized assistance, feel free to reach out. Good luck with your business setup and banking in Dubai!

A business setup and strategy expert specializing in Dubai. Shayan Nasiri co-founded GenZone with Kevin McKenzie to help entrepreneurs and professionals navigate company registration, banking, and taxation, making it easy to start and grow a business in the UAE.